15 September 2025

International Expansion Strategies – 2025 Guide

(+ Free Framework)

TL;DR – 7 Proven International Expansion Strategies

- Exporting: Test demand with minimal risk

- Licensing: Monetise IP without heavy spend

- Franchising: Scale fast with local partners

- Joint Ventures: Share risk and local know-how

- Strategic Alliances: Collaborate for reach and resources

- Foreign Direct Investment: Full control, higher cost

- M&A: Instant market access, complex integration

Why a Clear International Expansion Strategy Matters

Fewer than 1% of start-ups ever secure funding and reach the growth stage. For those that do, the pressure is immediate: investors expect rapid, international-scale growth. The right market entry strategy is no longer optional – it’s a prerequisite for scaling efficiently and securing subsequent rounds of funding.

Investor Lens: VCs benchmark expansion readiness on hard metrics. According to PitchBook, 71% of Series A founders choose an Employer of Record (EoR) as their first step abroad. Why? It allows them to test markets quickly without overcommitting capital.

A clear international expansion strategy signals not just ambition but operational discipline, which is exactly what investors look for before writing the next cheque.

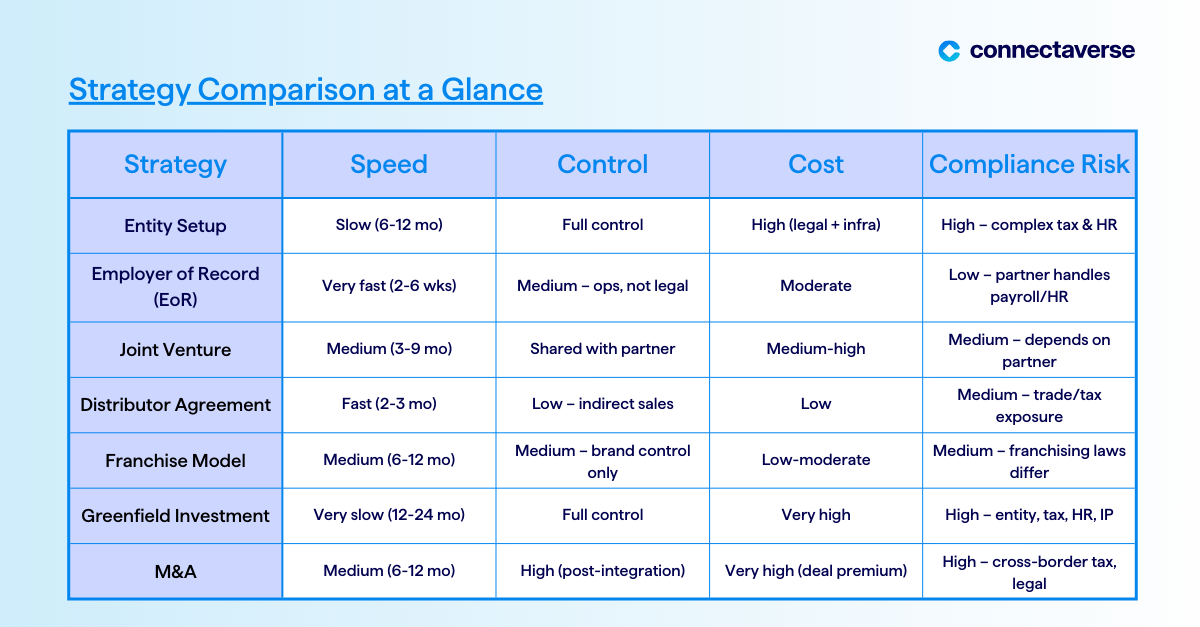

Comparing International Expansion Strategies

Each market entry model offers a different trade-off between speed, control, cost, and compliance risk. Choosing the right one depends on your growth stage, capital runway, and investor expectations.

Real-World Snippet

One SaaS scale-up we tracked reached $3M ARR in its home market, then used an EoR to test LATAM. Within 9 months, recurring revenue doubled, and investors green-lit a $20M Series A. Speed to market, not entity control, was the deciding factor.

For deeper due diligence on compliance obligations, see the OECD BEPS framework, the World Bank Doing Business indicators, and EY’s International Tax Guide.

Deep Dive Into 7 Global Expansion Strategies

Each international expansion strategy comes with unique pros and cons. The right choice depends on your timeline, budget, and the level of control you need. Let’s break down seven proven approaches – with advantages, expansion challenges, and real-world examples – so you can see which path aligns best with your growth stage.

Exporting: Is It the Easiest Way to Test New Markets?

Exporting is often the first step for scale-ups entering international markets. It’s low-cost and relatively low-risk, since you can leverage distributors or online platforms without setting up local operations.

- Pro: Fast to implement, minimal investment.

- Con: Limited control over brand and customer experience.

- Example: Many consumer goods companies build recognition abroad by exporting through Amazon or Alibaba before committing to local offices.

Licensing: How Can You Monetise IP Globally?

Licensing allows you to grant rights to a local company to manufacture or sell your products. It’s a lean route to extend reach and generate royalties without heavy investment.

- Pro: Cost-effective, scalable, passive revenue streams.

- Con: Risk of losing quality or brand control.

- Example: Supercell licensed its Clash of Clans IP to merchandising partners, boosting global brand visibility while staying focused on core game development.

Franchising: Can Local Partners Accelerate Your Growth?

Franchising leverages local entrepreneurs who replicate your model under your brand. It enables rapid global scaling while shifting much of the financial risk to franchisees.

- Pro: Strong local knowledge, lower upfront costs.

- Con: Brand consistency can be harder to enforce.

- Example: Subway has over 40,000 outlets worldwide thanks to its franchise-first model, relying on local owners to adapt to cultural nuances.

Joint Ventures: When Should You Share Risk With a Partner?

Joint ventures combine your strengths with a local player’s insights and infrastructure. They’re ideal in complex or highly regulated markets where going solo is risky.

- Pro: Access to market knowledge and networks.

- Con: Risk of conflicts over control or profit-sharing.

- Example: Jaguar Land Rover’s JV with Chery in China gave it access to one of its largest growth markets while navigating local regulations.

Strategic Alliances: How Do You Expand Without Equity?

Strategic alliances are flexible, non-equity partnerships built around shared goals like distribution, R&D, or marketing. They require less commitment than a JV but can deliver major reach.

- Pro: Resource sharing, faster access to customers.

- Con: Dependence on partner performance, limited control.

- Example: Tech firms often use alliances with local telecoms to reach users without building their own infrastructure.

Foreign Direct Investment: What Does Full Control Look Like?

FDI means establishing subsidiaries, facilities, or offices abroad. It gives you full control over operations but requires significant time and capital.

- Pro: Brand credibility, long-term market commitment.

- Con: High cost, high compliance burden.

- Example: GSK built R&D centres in India and China to tailor pharma products to local health needs, deepening government ties and market share.

Mergers & Acquisitions: Is Buying Faster Than Building?

M&A lets you buy into a market by acquiring or merging with an established local business. It’s fast but comes with integration risks.

- Pro: Instant customer base and infrastructure.

- Con: Expensive deals, cultural and operational integration challenges.

- Example: Vodafone’s acquisition of Mannesmann in 2000 instantly made it a global telecom giant.

Adapting and Localising for Global Success

Choosing the right strategy is only the first step. To thrive abroad, your business model must adapt to local consumer behaviour, cultural norms, and regulations. What resonates at home may not translate overseas, and failure to localise is a leading cause of international expansion setbacks.

Adapting to Market Dynamics

Consumer preferences differ widely: German buyers often prioritise quality and sustainability, while Indian customers may be more price-sensitive. Your pricing, packaging, and even product features may need adjustments to stay relevant.

Localisation in Practice

- Netflix built its subscriber base in India by producing original Hindi content, rather than only exporting Western shows.

- KFC in Japan created a Christmas-specific menu, embedding itself in a national holiday tradition and ensuring repeat seasonal sales.

Real-World Example: Aircall LATAM

Aircall, a Paris-based SaaS scale-up, expanded into Latin America after its Series B. Instead of setting up costly subsidiaries, it used an Employer of Record to hire quickly and test the region. Within 9 months, recurring revenue doubled, helping secure a $65M Series C. The takeaway: localisation isn’t only about messaging — adapting the entry model itself can be decisive.

By aligning your product, marketing, and operational setup with local realities, you build trust, accelerate adoption, and strengthen your global brand.

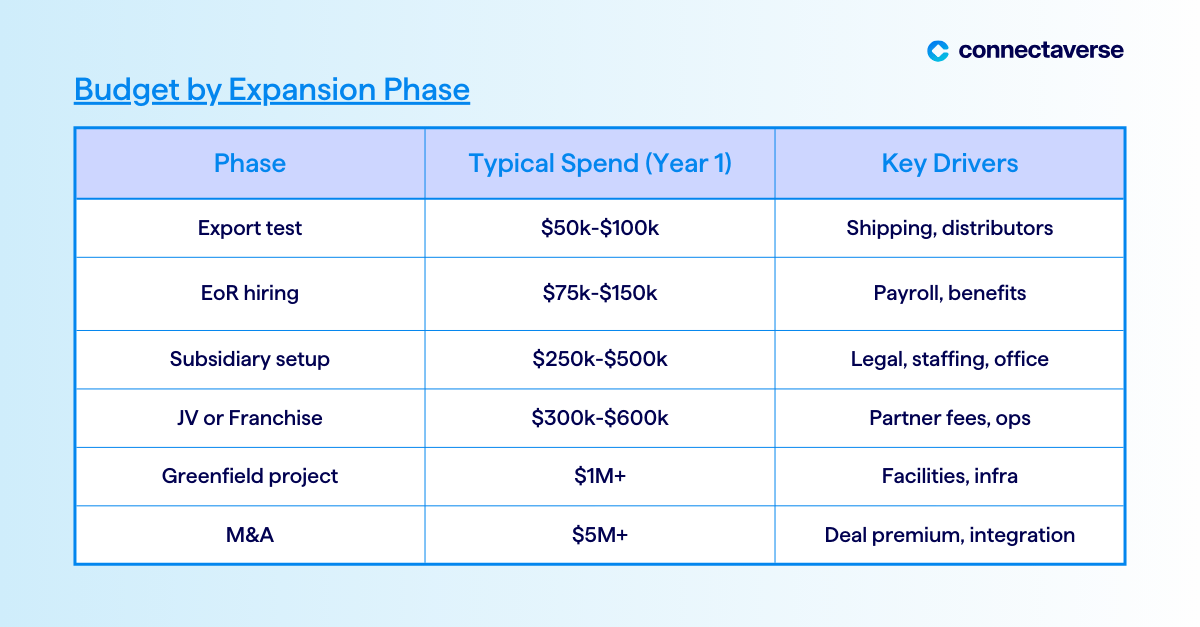

Managing Costs, Risks, and Timelines

Expanding abroad isn’t just about ambition – it’s about resourcing correctly. A realistic budget, risk plan, and exit strategy protect your company from costly missteps.

Budget by Phase

Expansion costs scale with commitment. Early moves like exporting or EoR may only require $50k-$150k in setup and first-year spend, while full subsidiaries or M&A can run into the millions. A phased approach spreads costs and allows you to validate markets before deeper investment.

Risk Mitigation

- Hedge currency exposure with forward contracts or options.

- Use compliance software and local counsel to avoid regulatory missteps.

- Keep contingency funds (10-15% of budget) for delays or disruption.

Exit Strategy

Not every market works out. Set KPIs (ARR, payback, churn) to trigger reviews. If thresholds aren’t met, plan a structured exit: close entities cleanly, repatriate IP, and communicate transparently with stakeholders to protect your reputation.

What Investors Look For

More than expanding your customer base, global expansion is about signalling scale to investors. Less than 1% of start-ups ever secure funding, and those that do are expected to show credible pathways to international markets.

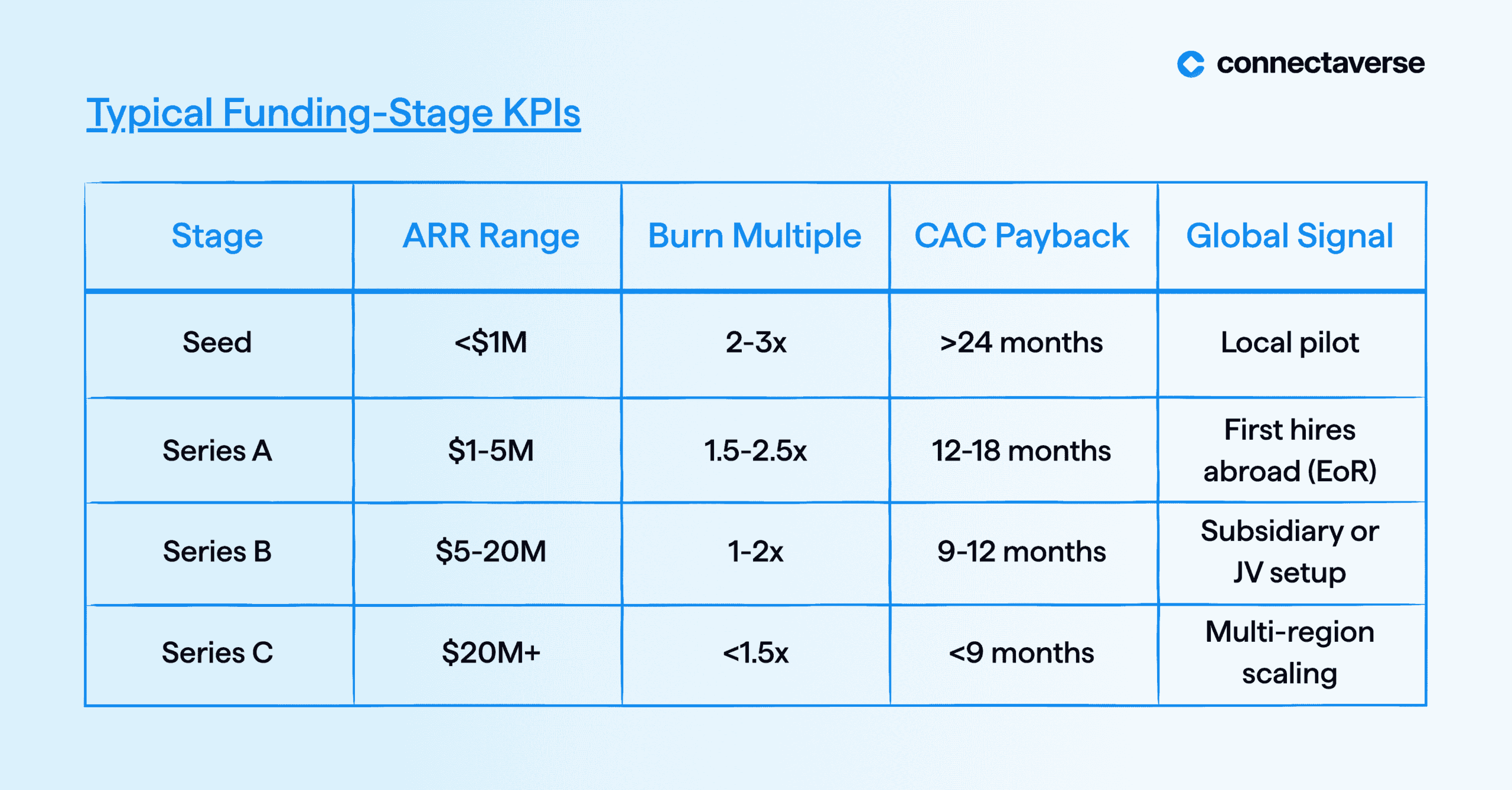

Investor Lens: Benchmarks by Stage

- Seed: $500k-$2M ARR │ Focus on product–market fit, early export pilots

- Series A: $3M-$8M ARR │ Burn multiple < 2.0x │ 71% of founders choose EoR to prove traction fast

- Series B: $10M-$25M ARR │ CAC payback < 18 months │ First entities/JVs live

- Series C: $30M+ ARR │ Global sales split > 30% │ FDI or M&A in play

Due Diligence Checklist

When VCs review your expansion plans, they’ll probe:

Choosing the Right Strategy for Your Business

With so many routes available, the key is narrowing options to what fits your stage and resources. A simple framework:

- Assess Your Goals: Are you aiming for quick traction, long-term control, or investor signalling?

- Check Available Resources: Map budget, talent, and operational capacity to realistic market-entry choices.

- Define the Control–Speed Trade-off: EoR or exporting provide agility; entities, JVs, and FDI offer more control but take time.

- Match Goals to Strategy: Align your priorities with the model that balances cost, risk, and scalability.

Final Insights: Is Global Expansion Worth It in 2025?

Global expansion always carries risks – from compliance hurdles to cultural missteps – but with the right strategy and trusted partners, those challenges become stepping stones to business growth. Scale-ups and VC-backed firms that plan carefully, localise effectively, and choose the right market-entry path can unlock new revenue, diversify risk, and strengthen investor appeal.

Ready to explore your best-fit approach? ConnectaVerse links you directly with vetted service providers for entity setup, EoR hiring, tax, and compliance across global markets. Start your journey today with our International Expansion Services.

FAQs About International Expansion Strategies

Q: What is the cheapest international expansion strategy?

A: Exporting or using an Employer of Record (EoR) are usually the lowest-cost entry points, requiring little upfront infrastructure.

Q: What is the fastest way to expand abroad?

A: An EoR enables compliant hiring in days, while exporting through distributors lets you test demand almost immediately.

Q: What are the tax implications of global expansion?

A: Tax rules vary by country and may trigger double taxation. Planning with local advisors and using treaties can reduce exposure.

Q: When should a company switch from EoR to entity formation?

A: Most firms transition once they reach 5-10 employees in a market, or when long-term contracts and compliance needs grow.

Contact us

Isidro Helder

ConnectaVerse B.V.

Nieuwezijds Voorburgwal 271

1021 RL Amsterdam

The Netherlands