23 August 2025

The 5 Biggest International Expansion Challenges

(& How to Fix Them in 2025)

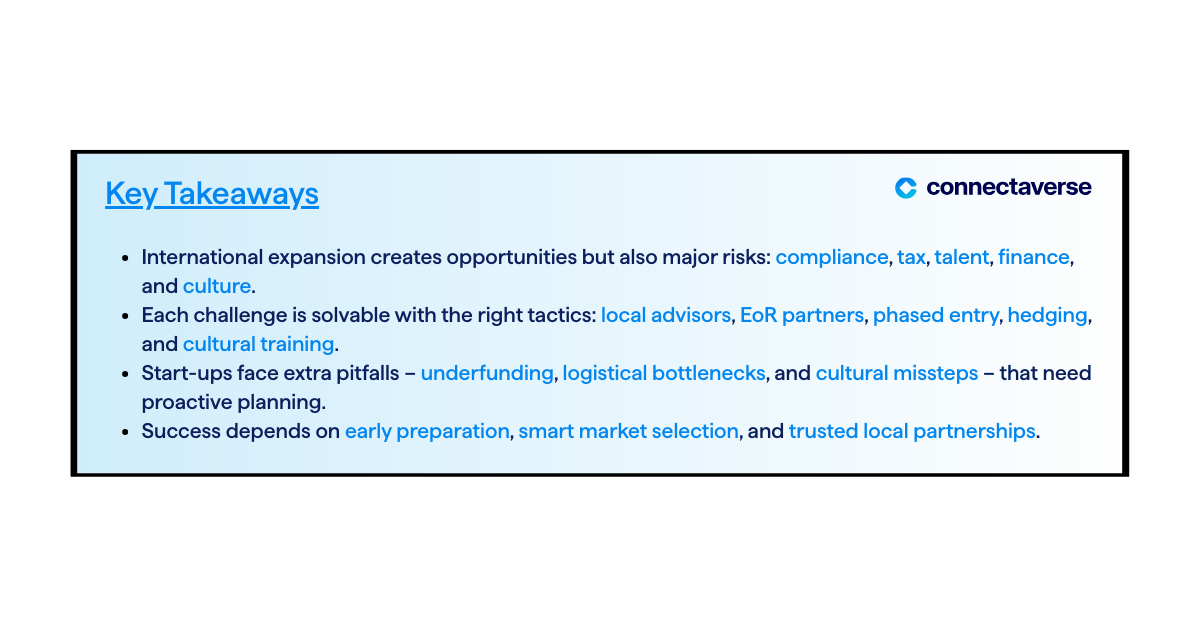

TL;DR – What are the 5 Biggest Challenges of International Expansion? (& How to Fix)

- Regulatory Minefields → Engage local counsel early

- Tax & Double-Taxation Risks → Use treaties + local advisors

- Talent Shortages → Hire via Employer of Record (EoR)

- Cash-Flow & Currency Swings → Hedge exposure + phase entry

- Cultural Fit → Train teams + localise marketing

Challenge 1: How Do You Navigate Complex Regulations When Expanding Internationally?

Every country has its own rules for data protection, labour, and trade, and what’s legal in one market may be prohibited in another. For scale-ups, this patchwork of laws can slow entry, increase costs, or even block operations. Regulatory mistakes are among the most common (and expensive) international expansion hurdles.

How to solve it:

- Engage local counsel early to map compliance requirements.

- Automate compliance tracking with audits, training, and documentation.

- Use entity or Employer of Record (EoR) partners to handle employment law.

Challenge 2: How Do You Manage Tax and Double Taxation Risks?

Expanding abroad means entering new tax systems – often overlapping ones. Without careful planning, scale-ups can face double taxation, unexpected VAT liabilities, or higher corporate tax rates that eat into margins. Start-ups in particular feel the strain of extra operating costs like local registrations, payroll taxes, and cross-border reporting. Missteps here can quickly turn a promising market entry into a drain on cash flow.

How to solve it:

- Use international tax treaties to avoid double taxation.

- Work with local tax advisors to map obligations early.

- Enter new markets in phases to limit exposure and spread costs.

Challenge 3: Why Is Finding and Retaining the Right Talent So Hard in Global Expansion?

Among the biggest challenges of expanding internationally is building the right team abroad. Local regulations, cultural differences, and scarce specialist skills make it difficult to recruit and retain top talent. Many scale-ups find that hiring delays slow their market entry, or that mismatched hires increase costs and turnover. Without trusted local insight, even well-funded companies risk burning through budgets without securing the people needed to grow.

How to solve it:

- Hire quickly and compliantly through an Employer of Record (EoR).

- Partner with trusted local recruiters who know the talent market.

- Provide cultural training to integrate teams and reduce turnover.

Challenge 4: How Do You Control Cash Flow and Currency Exposure?

Currency swings and unpredictable costs are some of the toughest expansion challenges for start-ups. A favourable exchange rate one month can become a margin killer the next. For growth-stage companies, even small shifts in foreign currency can inflate supplier costs, squeeze profits, or delay payroll. Add in differences in local financial regulations, and cash flow quickly becomes one of the most common reasons global expansion stalls.

How to solve it:

- Hedge exposure with forward contracts or options to lock rates.

- Enter new markets in phases to spread financial risk.

- Use ERP or financial software to monitor cash flow in real time.

Challenge 5: How Do You Bridge Cultural Differences in Global Expansion?

Cultural missteps are one of the most underestimated start-up expansion challenges. Nearly 45% of start-ups report setbacks caused by failing to adapt to local customs. A marketing campaign that works at home may fall flat – or even offend – abroad. In India, brands like McDonald’s adapted their menus with vegetarian options to win customers. In China, business relies heavily on guanxi (relationships), where trust and respect matter as much as price. Without this awareness, companies risk poor traction, damaged reputations, and stalled growth.

How to solve it:

- Hire local staff who understand cultural and linguistic nuances.

- Provide cultural awareness training to global teams.

- Adapt messaging and products to local expectations.

Start-Up Specific Pitfalls (and Fixes)

Founders we work with hit these snags most often:

- Underfunding Global Operations: Many start-ups underestimate set-up and compliance costs.

→ Fix: Phase entry into lower-cost markets first. - Regulatory Blind Spots: Overlooking local laws around tax, data, or labour.

→ Fix: Engage local counsel before launch to avoid penalties. - Cultural Missteps: Campaigns or products that don’t translate across borders.

→ Fix: Hire local staff and adapt messaging early. - Logistical Bottlenecks: Delays from customs, shipping, or poor infrastructure.

→ Fix: Partner with reliable 3PL providers to simplify supply chains. - Talent Mismatches: Hiring too fast or without local insight.

→ Fix: Use EoR partners and trusted recruiters to secure the right fit.

Is International Expansion Worth the Challenge?

Global growth isn’t easy – the hurdles are real, from compliance risks to cash-flow pressures. But every one of these challenges is solvable with the right preparation, local insight, and trusted partners. Start-ups and scale-ups that plan ahead, adapt to cultural differences, and secure expert support can transform international expansion from a high-risk gamble into a long-term growth engine.

Ready to tackle your own expansion hurdles? ConnectaVerse links you with vetted legal, tax, HR, and compliance experts worldwide, so you can expand globally with confidence. Talk to ConnectaVerse today.

FAQs About the Challenges of International Expansion

Q: What is the biggest compliance risk when expanding abroad?

A: The most common compliance risk is overlooking local employment and tax laws. Each market has its own rules, and missing requirements can result in fines, legal disputes, or blocked operations. Engaging local counsel early helps mitigate this risk.

Q: How do I avoid double taxation?

A: Double taxation occurs when income is taxed both in the home country and the host country. The fix is to use international tax treaties, structure entities correctly, and work with local tax advisors to map obligations before entry.

Q: How long does entity setup take?

A: Entity setup varies by country, from as little as 2 weeks in Singapore to several months in markets with stricter approvals like Brazil or India. Using an Employer of Record (EoR) can let you hire in days while the entity is being processed.

Q: What are talent costs vs EoR?

A: Hiring directly requires full local compliance costs (entity setup, payroll, benefits, HR admin). With an EoR, fees are typically 10-15% of payroll, but you gain speed, compliance, and reduced overhead – often the more efficient option for start-ups expanding abroad.

Contact us

Isidro Helder

ConnectaVerse B.V.

Nieuwezijds Voorburgwal 271

1021 RL Amsterdam

The Netherlands