16 September 2025

Market Entry Strategy Framework: 6-Step Model

TL;DR – The 6-step Framework

- Research: Size demand, scan competitors, flag regulatory red lines.

- Validation: Run lean tests; confirm willingness-to-pay and sales velocity.

- Mode: Pick entry route balancing speed, control, cost, and compliance.

- Budget: Model setup/OPEX, add 10–15% contingency, plan hedges.

- Pilot: Hire small, land first logos, codify learnings in 90 days.

- Scale: Switch to entity when thresholds hit; standardise ops and governance.

How Do You Research Market Fit Before Expanding?

The first step in any market entry strategy framework is understanding whether the opportunity is real and scalable. That means going beyond gut feel and gathering hard data on:

- TAM, SAM, SOM: Define the total, serviceable, and obtainable markets.

- PESTLE factors: Map political, economic, social, tech, legal, and environmental drivers.

- Competitor analysis: Spot gaps in pricing, product mix, or customer experience.

- Tools & Sources: World Bank Doing Business reports, OECD data, local chambers of commerce, analyst decks, and customer interviews.

How Do You Validate Demand Before Committing?

Once you’ve identified a promising market, the next step is proving real customer appetite. Instead of jumping straight into a full-scale setup, run lean tests that de-risk your decision:

- Export trial: Ship limited batches through distributors or online marketplaces.

- Landing pages: Launch geo-targeted pages to test sign-ups or early conversions.

- Distributor talks: Gauge interest and terms from local partners.

- Willingness-to-pay: Run surveys or pilots to see if pricing holds.

VC angle: Investors want to see hard proof that demand exists. Showing early traction through pilots and market tests gives confidence that your expansion strategy is grounded in evidence, not just ambition.

How Do You Choose the Right Market Entry Mode?

Once you’ve validated demand, the next decision is how to enter. Each entry mode comes with its own trade-offs:

- Employer of Record (EoR): Fast hiring without an entity.

- Entity setup (subsidiary/branch): Full control, higher cost.

- Joint Venture (JV): Share risk and gain local know-how.

- Distributor/Reseller: Quick reach, low control.

- Franchise: Scale fast with partners.

- Greenfield investment: Build from scratch, maximum control.

- M&A: Buy your way in, but complex.

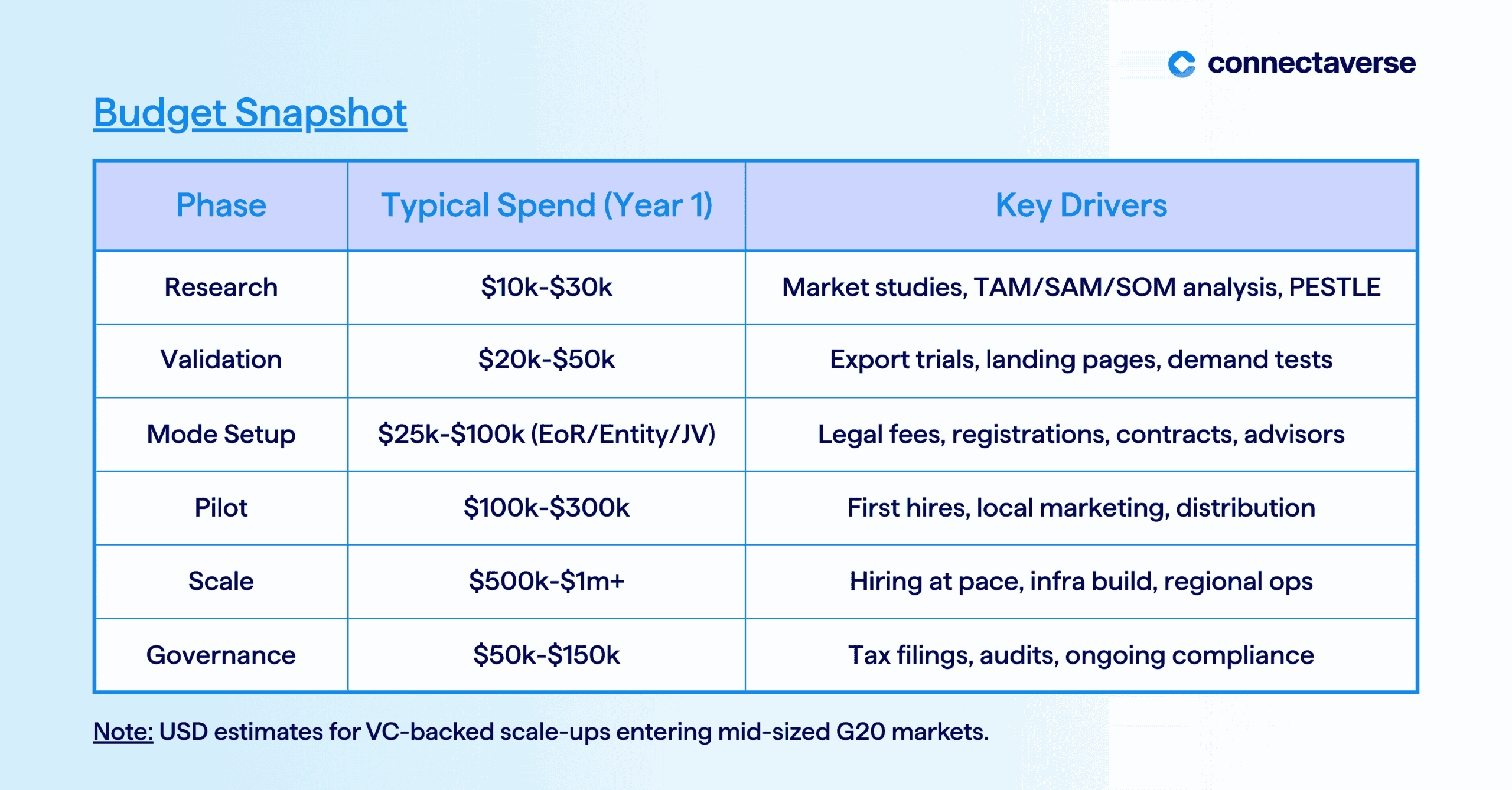

What Budget and Timeline Should You Plan For?

Global expansion can move faster than many founders expect, but costs also scale quickly. Most investors want to see a budget and timeline that accounts for both setup and ongoing OPEX, broken down by entry mode.

Year 1 costs typically break into setup (legal, registrations, hiring) and ongoing OPEX (payroll , compliance, marketing). Timelines vary widely, from 1-3 months for EoR hires to 18+ months for greenfield builds.

Always pad forecasts with a 10-15% contingency for currency swings, regulatory changes, or slower-than-expected onboarding.

How Do You Run a Pilot and Learn Fast?

Before committing major resources, treat your first 90 days in a new market as a pilot phase. The goal is to validate demand, stress-test operations, and prove the business case for scale.

Your pilot should include:

- Hiring 1-2 local team members or EoR staff.

- Securing first customer logos or distributor contracts.

- Running structured feedback loops with early adopters.

- Checking compliance hygiene (contracts, tax, payroll).

KPIs to track:

- ARR added: How much new revenue comes from the pilot market?

- CAC payback: Are you acquiring customers at sustainable cost?

- Churn: Do early customers stay beyond the first cycle?

- Time-to-invoice: How fast do deals move from signed to cash?

How Do You Scale and Govern Global Operations?

Once your pilot shows traction, scaling requires discipline, not just speed. The shift from “testing” to “committing” should be based on clear conditions. With the right governance cadence, international markets scale sustainably, keeping investors confident and operations resilient.

Scale triggers to watch for:

- Headcount thresholds: When local teams exceed 8–10, consider switching from EoR to entity.

- Finance readiness: Centralised reporting, local payroll integration, and treasury controls in place.

- Tax guardrails: Document transfer pricing policies and monitor permanent establishment risk.

Governance to keep growth healthy:

- Quarterly market reviews: Track ARR, CAC payback, and regulatory changes.

- Exit criteria: Define performance floors – when to pull back or pivot.

- Partner audits: Check local counsel, payroll providers, and distributors yearly for compliance.

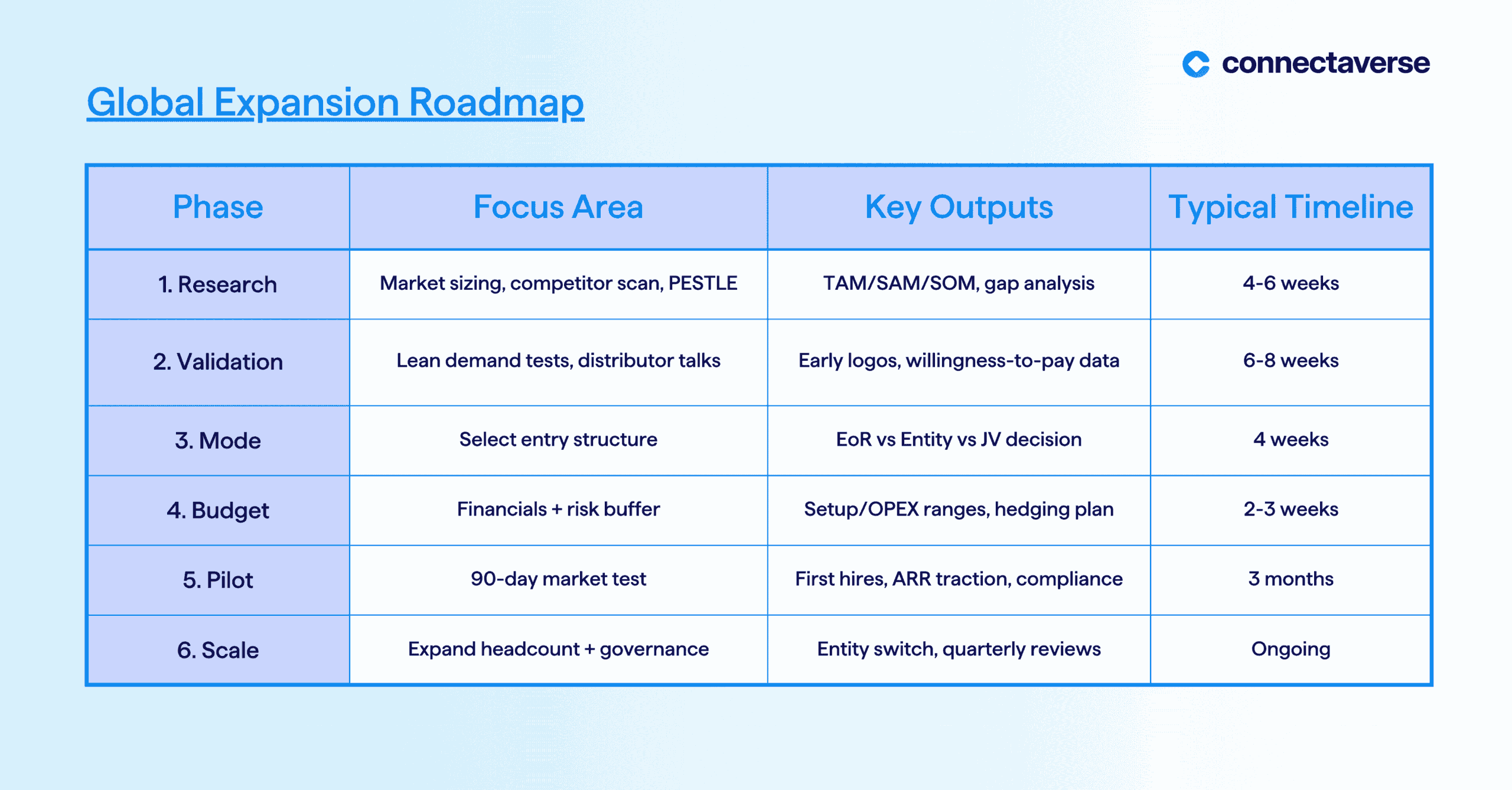

Quick-View Roadmap

Global expansion is easier to manage when you follow a clear, phased model. Use this six-step roadmap to track progress and align stakeholders.

Pro tip: Pair each phase with measurable KPIs. Investors expect milestones, not just intentions.

Real-World Example: Monzo’s US Launch

In 2019, UK-based challenger bank Monzo attempted a US entry. The sequence was lean: a small pilot, limited debit card rollout, and partnerships with local banks. The main constraint was regulatory approval: Monzo lacked a US banking licence, limiting its product scope. The decision to prioritise speed-to-market gave them early brand awareness but little traction compared to domestic competitors. By 2021, Monzo paused operations to reassess.

- What we’d copy: Phased launch, low capital burn.

- What we’d change: Deeper regulator engagement, clearer product-market fit signals before scaling.

Need country-specific help? Expanding abroad means navigating local laws, tax rules, and HR regulations. We connect you with vetted experts in each market so you can move with confidence.

Market Entry Strategy FAQs

Q: What is the best market entry framework?

A: The most reliable models break expansion into six phases: Research, Validation, Entry Mode, Budget, Pilot, and Scale. This phased approach keeps investors aligned and reduces execution risk.

Q: How long does international expansion take?

A: Timelines vary, but most scale-ups spend 6-12 months from research to pilot. Complexity rises sharply with regulated sectors or when setting up full entities.

Q: What budget range should I expect?

A: Entry via EoR or distributor can start under $100k in Year 1. Entity formation or JV typically runs $250k-$1M depending on headcount, compliance, and infrastructure.

Q: What are the most common pitfalls?

A: Skipping market validation, underestimating compliance costs, and misjudging cultural fit. Each can derail growth, which is why a phased framework is critical.

Contact us

Isidro Helder

ConnectaVerse B.V.

Nieuwezijds Voorburgwal 271

1021 RL Amsterdam

The Netherlands